Client

NFTYDoor

Project

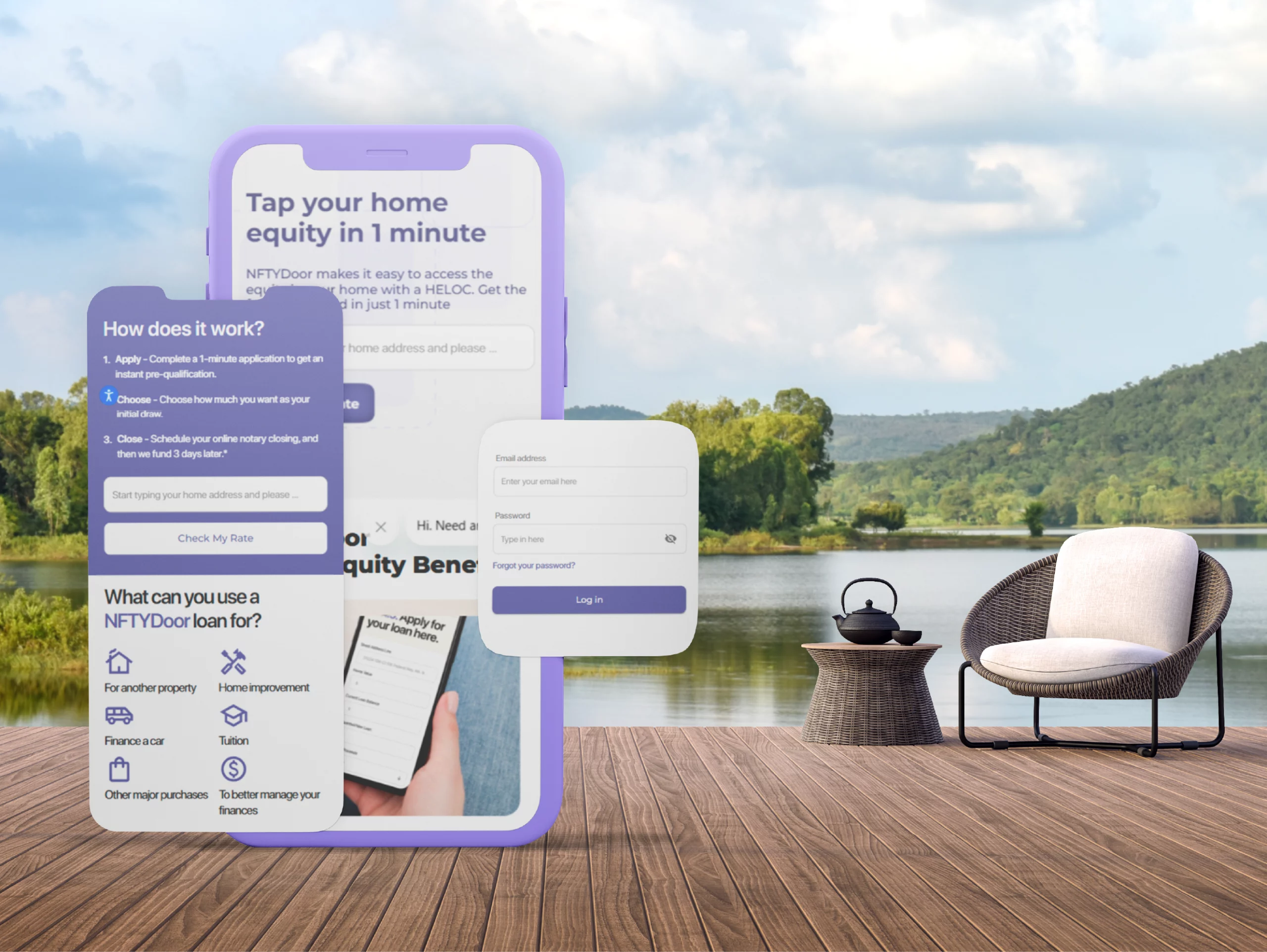

NFTYDoor is a fintech company revolutionizing the mortgage industry by providing a seamless digital experience. Its innovative approach includes a simple online application, autonomous underwriting, automated processing, and digital closing; granting homeowners on-demand access to the $15 trillion U.S. home equity market.

NFTYDoor was founded by Mark Schacknies and Jonathan Spinetto, serial fintech entrepreneurs with over 50 years of combined experience in real estate, finance, and technology. Headquartered in McLean, Virginia, NFTYDoor went from 5 to all 50 US States with a globally distributed team.

Automation

Scalability

Compliance

Quality Assurance

At Crombie, we design tailored software solutions that drive real results and sustainable growth.